Depreciation calculator for computer

Qualified GO Zone property placed in service before Dec. Certain property with a long production period.

Declining Balance Depreciation Calculator Double Entry Bookkeeping Calculator Bookkeeping Accounting And Finance

Under the depreciation formula this converts to a Diminishing Value percentage rate of 50 per annum or Prime Cost 25.

. These properties might also qualify for a special depreciation allowance. Use our Rainfall Calculator to quickly determine how much rain has fallen in your location. Calculation of Depreciation enabled upto Financial Year 2021-22.

Computer software means any computer programme recorded on any disc tape perforated media or other information storage device. Enter an assets cost and life and our free MACRS depreciation calculator will provide the expense for each year of the assets life. This calculator performs calculation of depreciation according to the IRS Internal Revenue Service that related to 4562 lines 19 and 20.

Consolidated Summarised Fixed Asset Register enabled. Qualified Liberty Zone property placed in service before Jan. MACRS Depreciation Calculator Help.

A delivery truck for example might lose 20 percent of its value every year for 10 years. Above is the best source of help for the tax code. ABCAUS Excel Depreciation Calculator FY 2021-22 under Companies act 2013 latest version 0504 download.

For example say you have a computer that falls into the MACRS 5-year table category and youve used that computer for 4 years the table tells you that you can deduct 1152 tax from that property. Use the alternate depreciation system instead. Whats in the Box Calculator batteries user guide leather carrying case instructions warranty information.

It offers your choice of German French English Spanish Italian or Portuguese language operation and a one-year warranty. Supports exact date cash flows easy bulk data entry saving and printing. Need to have Microsoft Excel 2010 above for Windows or Microsoft Excel 2011 above for Mac installed on your computer unless otherwise specified.

Calculate his annual depreciation expense for the year ended 2019. An Auditors Tool on Depreciation Calculation- Version 30 Compliant to Schedule II of Companies Act 2013. Since 6000 of the 10000.

Total amount of depreciation of an asset cannot exceed its a Depreciable value b Scrap value c Market value d None of these. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab. Under Companies Act 2013 The depreciation is calculated on the basis of the useful life of assets and not on the basis of the rate of depreciation.

The HP 17bII financial calculator has a built-in memory of 28K and power-off memory protection. Search for a suitable used car using your desired annual depreciation amount. You can use our depreciation calculator.

C Decrease each year d None of them. If the business use of the computer or equipment is 50 or less you cant take a Section 179 deduction or MACRS. Input details to get depreciation.

Prepared as per Schedule-II. Special depreciation rules apply to listed. Financial Year 2015-16 to FY 2021-22 enabled FREE Download WHAT IS NEW- in this updated Version 30 1.

This IRR calculator calculates an annualized rate-of-return plus profit loss. The final MACRS Depreciation Rates Table tells you the tax percentage you can itemize for your asset. For the depreciation schedule for computers and computer equipment depreciation you may claim a deduction under Section 179.

Call our expert team today on 1300 728 726 or complete the form below to find out how we can help you maximise the deductions from your investment property. It has a five-year. Is a property a good investment.

Depreciation inflation and more. The formula to calculate depreciation through the double-declining method is. Calculate Property Depreciation With Property Depreciation Calculator.

Depreciation rates as per income tax act for the financial years 2019-20 2020-21 are given below. Where NBV is costs less accumulated depreciation. Many assets such as computer equipment quickly become obsolete and lose most of their value in the earlier years of their life compared to their later years.

The Investment Property Depreciation Calculator is developed to help property investors to estimate the tax depreciation deductions of the depreciating assets. Not Book Value Scrap value Depreciation rate. According to straight line method of providing depreciation the depreciation a Remains constant b Increase each year.

Click to See Full Template Click to see moreClick to see more Version 12544 Downloads 302 KB File Size January 4 2022 Updated 18 Number of comments Rating Download this template for free Get support for this template table of content Financial Ratio CategoriesLiquidity RatiosSolvency RatiosActivity RatiosProfitability RatiosHow to Use. You have a computer. Our calculator is also a good tool to use when you are still planning to build your rainwater catchment system.

Or calculate depreciation of any vehicle by providing its details. Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential real property. Depreciation rules for listed property.

If you have a question about the calculator and what it does or does not support feel free to ask it in the comment section on this page. Hence the depreciation expense for 2018 was 8500-500 15 1200. You can also use an online diminishing value depreciation calculator to calculate the values.

Only 2000 of the 10000 in five-year property was placed in service during the fourth quarter so both the computer and printer will be depreciated using the HY convention. MobilePortable Computers including laptops and tablets effective life of 2 years from 1 July 2016 Under the depreciation formula this converts to a Diminishing Value percentage rate of 100 or Prime Cost 50. It and this calculator are smart enough to sort the cash flows.

A list of commonly used depreciation rates is given in a. Gain a proven solution for write-up AP AR payroll. S Reg Date Brand new car.

Get all the power of QuickBooks in a one-time purchase accounting software installed on your office computer. This is the straight-line method. In a calculator or computer E or e which stand for exponential are employed to denote the power of 10.

In accountancy depreciation refers to two aspects a decrease in the value of the assets and allocation of the cost of assets to the useful life of the assets. Gain a proven solution for write-up AP AR payroll bank reconciliation asset depreciation and financial reporting. Computer Software.

Request a tax depreciation schedule quote BMT has completed more than 800000 property depreciation schedules helping Australian taxpayers just like you save thousands of dollars every year. Allows for 1 or 2 mortgages. Knowing how much rain has fallen into your rainwater catchment system is useful when you are projecting your water harvesting capabilities.

E Notation E notation which is also referred to as exponential notation is like scientific notation in that it involves multiplying a decimal number between 1 and 10 by 10 raised to a.

Customer Acquisition Cost Calculator Plan Projections Financial Modeling Accounting And Finance How To Plan

Hp 10bii

Pin On Papelaria

Depreciation Schedule For Business Personal Property Template Schedule Templates Templates Schedule

Hp 12c 10 Digit Financial Calculator

Depreciation In Excel Excel Tutorials Microsoft Excel Tutorial Excel Shortcuts

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping Bookkeeping Templates Accounting Basics Learn Accounting

Methods Of Depreciation Learn Accounting Method Accounting And Finance

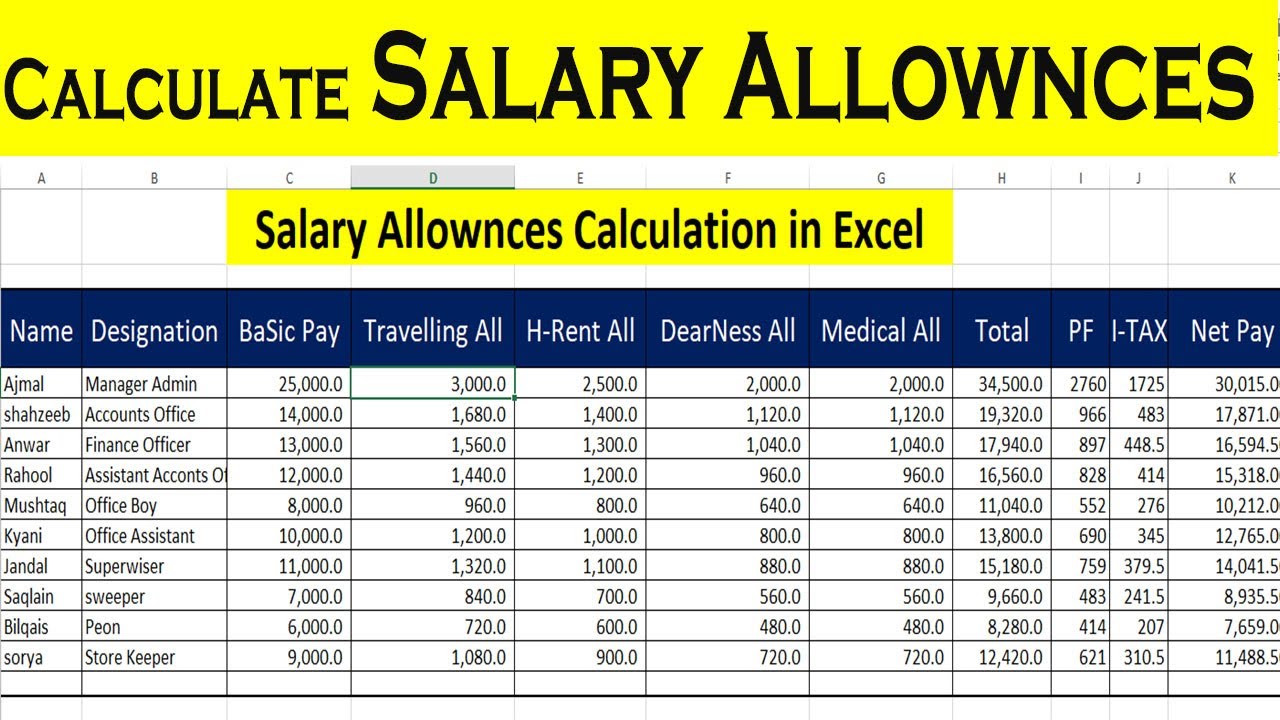

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Excel Learning Centers Tax Deductions

Beautiful Tire Shop Business Card Check More At Https Limorentalphiladelphia Com Tire Shop B Tax Deductions Free Business Card Templates Music Business Cards

Budget Calculator Use The Budget Calculator To Calculate Your Annual Budget Including Income Sources Assets And Exp Budget Calculator Budgeting Excel Budget

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Computer Generation Excel

How To Easily Calculate Straight Line Depreciation In Excel Exceldatapro Straight Lines Excel Line

Hp 17bii Financial Calculator Financial Calculator Calculator Paying Off Mortgage Faster

Sharp El 738fb 3 X 5 9 16 10 Digit 2 Line Financial Calculator Calculator Time Value Of Money

Hp 12c Scientific Calculator 30th Anniversary Edition Scientific Calculators Financial Calculators Calculator

Pin On Personal Computers